-

Email:

-

Phone:

+86-(0)21-2890-5605

-

Address:

FB-303, 699 Hongfeng Rd, Pudong, Shanghai, 201206

Fascinated by financial markets, my research centers around how investors price assets under real-world constraints.

A key theme of my research builds on the idea that investors navigate markets with imperfect information and must learn from data to form their subjective expectations. A series of my papers show such a fundamental challenge shapes how investors form their expectations about stock returns (paper 2, paper 3), firm earnings (paper 4), house prices (paper 1), and macroeconomic conditions (paper 5), which in turn sheds light on some puzzling market pricing patterns.

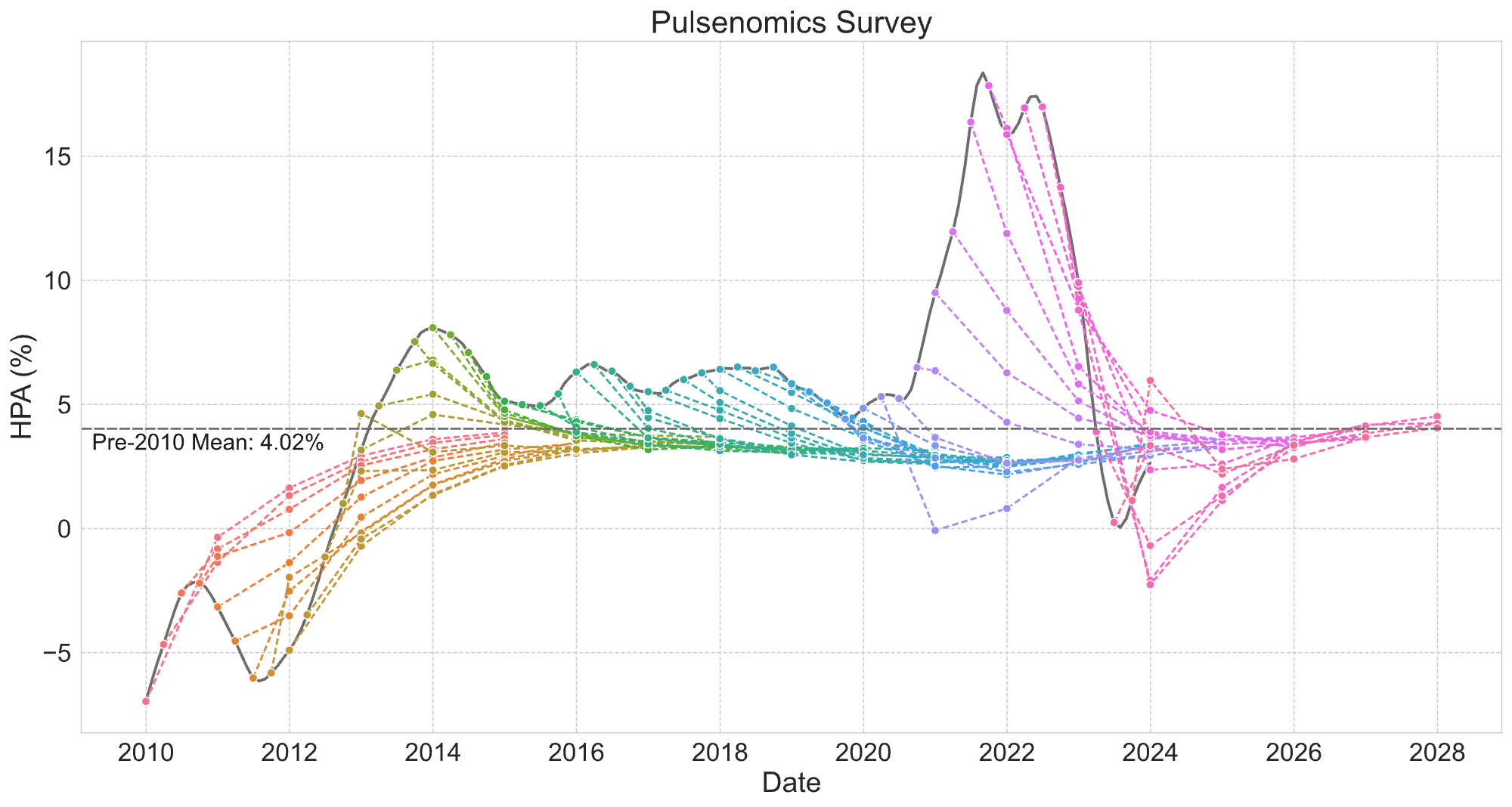

Seemingly puzzling patterns in house price growth forecasts are largely consistent with a model in which forecasters are uncertain about future long-run house price growth and have different prior beliefs. We employ large-scale cloud computing and a state-of-the-art learning model to demonstrate this effect based on a novel dataset.

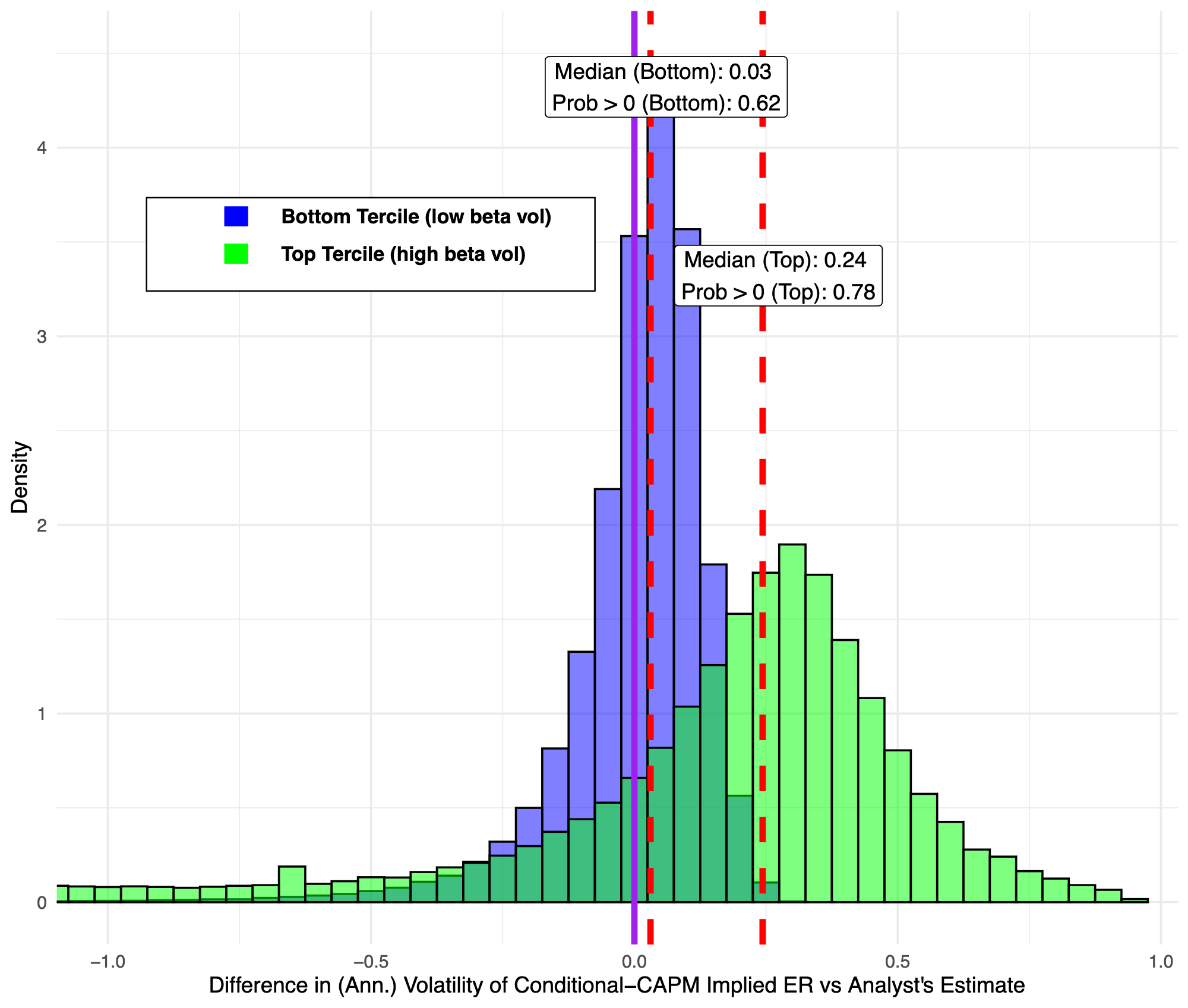

Investors underestimate the volatility of discount rates, which leads to asset pricing anomalies. A measure based on this underestimation explains 12 prominent cross-sectional anomalies.

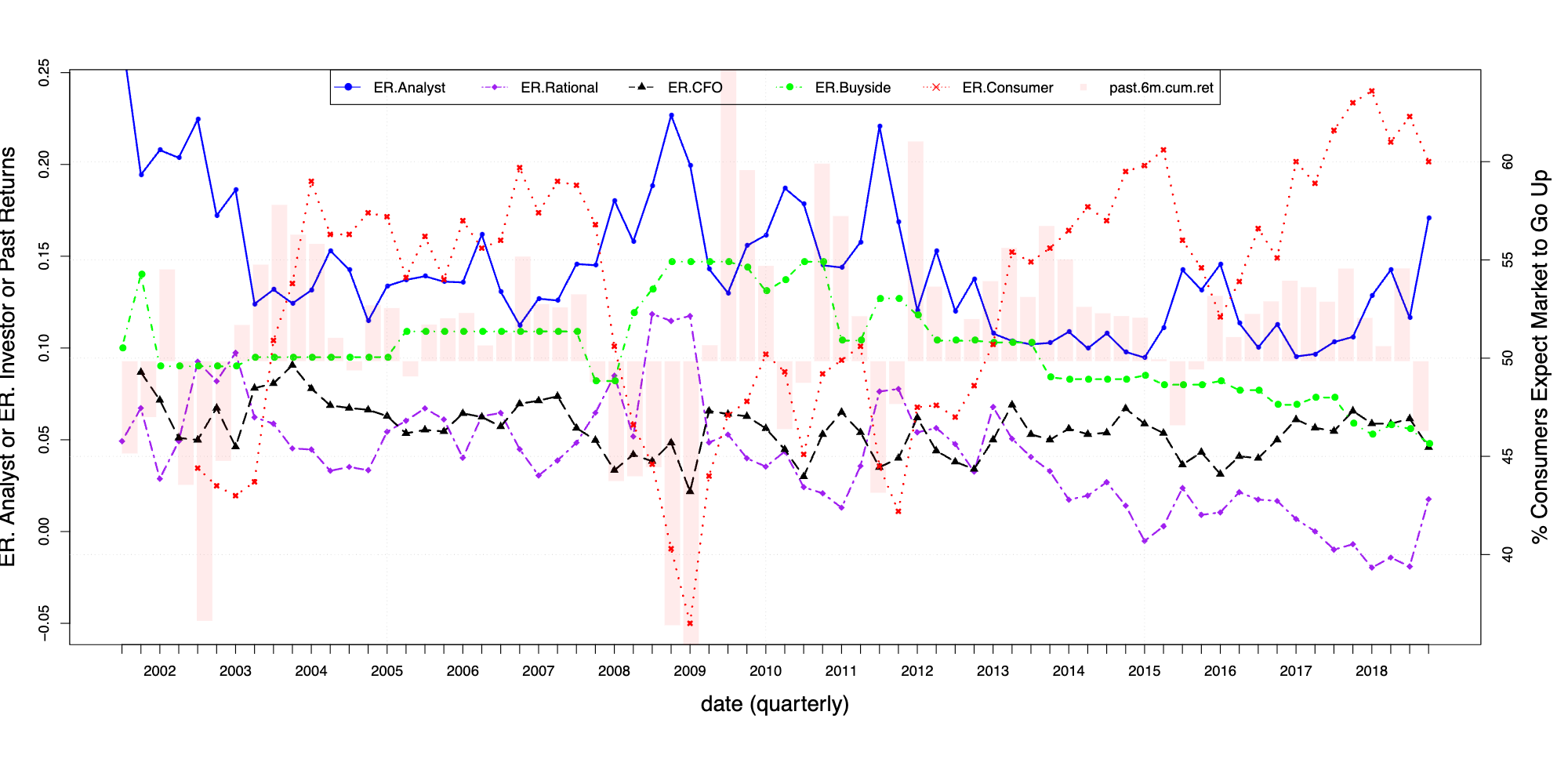

Wall Street and Main Street expectations about future stock returns are persistently opposed to each other. I demonstrate that this disagreement persists when they hold divergent views regarding how fundamental news relates to future stock prices.

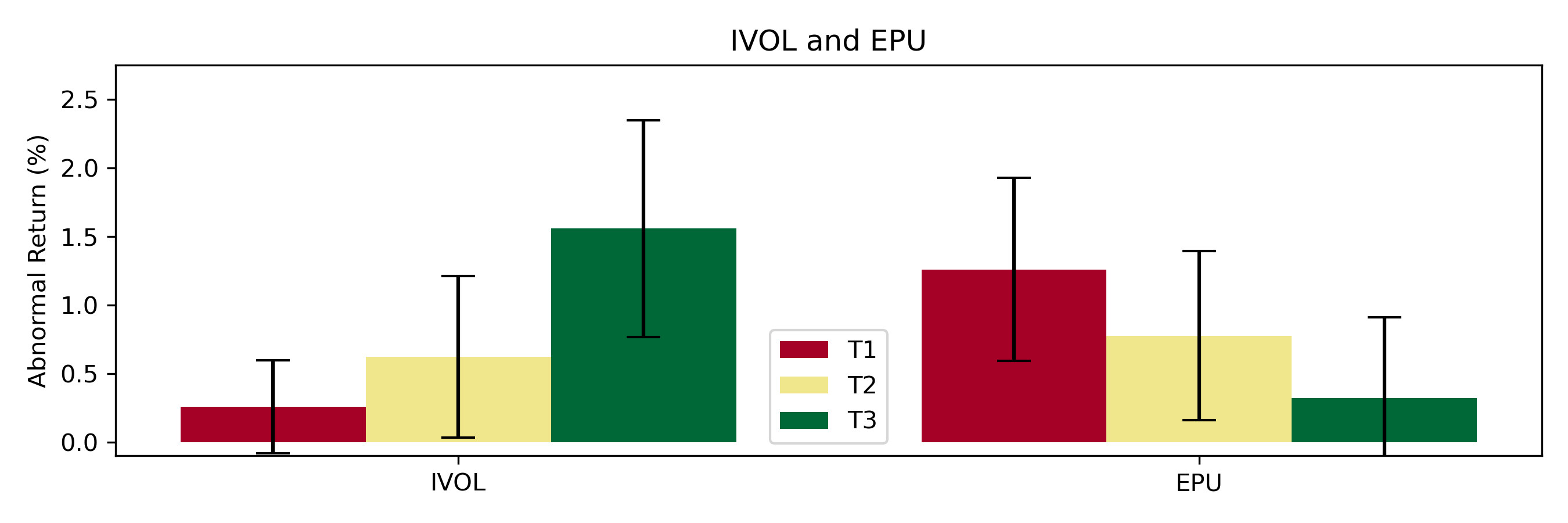

Uncertainty variations lead to opposite relationships with market efficiency over-time vs. cross-firm. We build an information-choice model to demonstrate this theoretically and confirm it empirically using analysts' forecast biases.

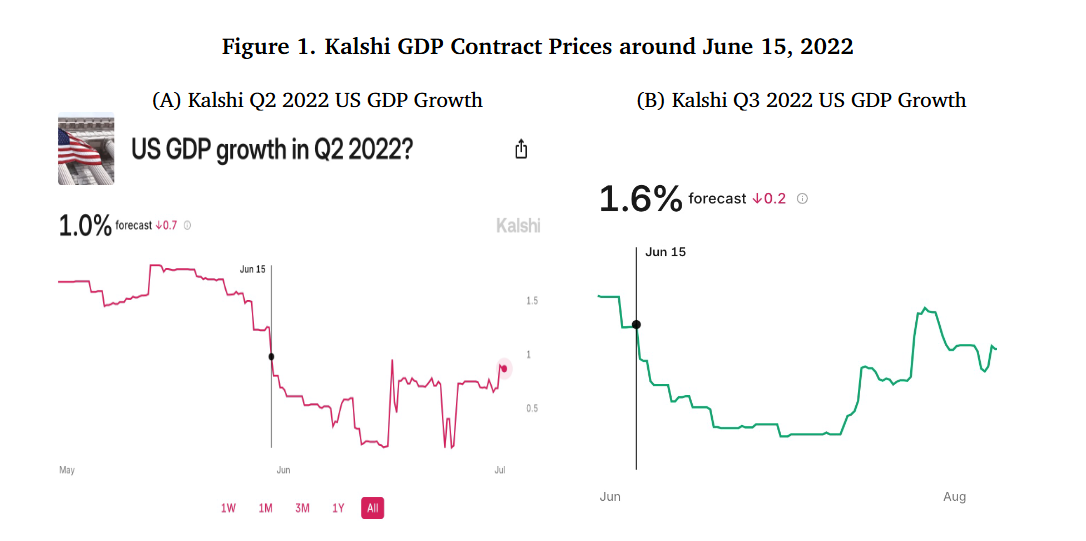

Traders in the Kalshi event contract markets are believers in the standard monetary policy transmission channels rather than the ‘Fed Information Effects.’ We use novel high-frequency data to identify this effect.

Recently, I've started to dive into the details in the Chinese financial markets and analyze how the trends of ESG Investing, (de-)globalization and governments' industrial policies impact asset prices and capital markets.

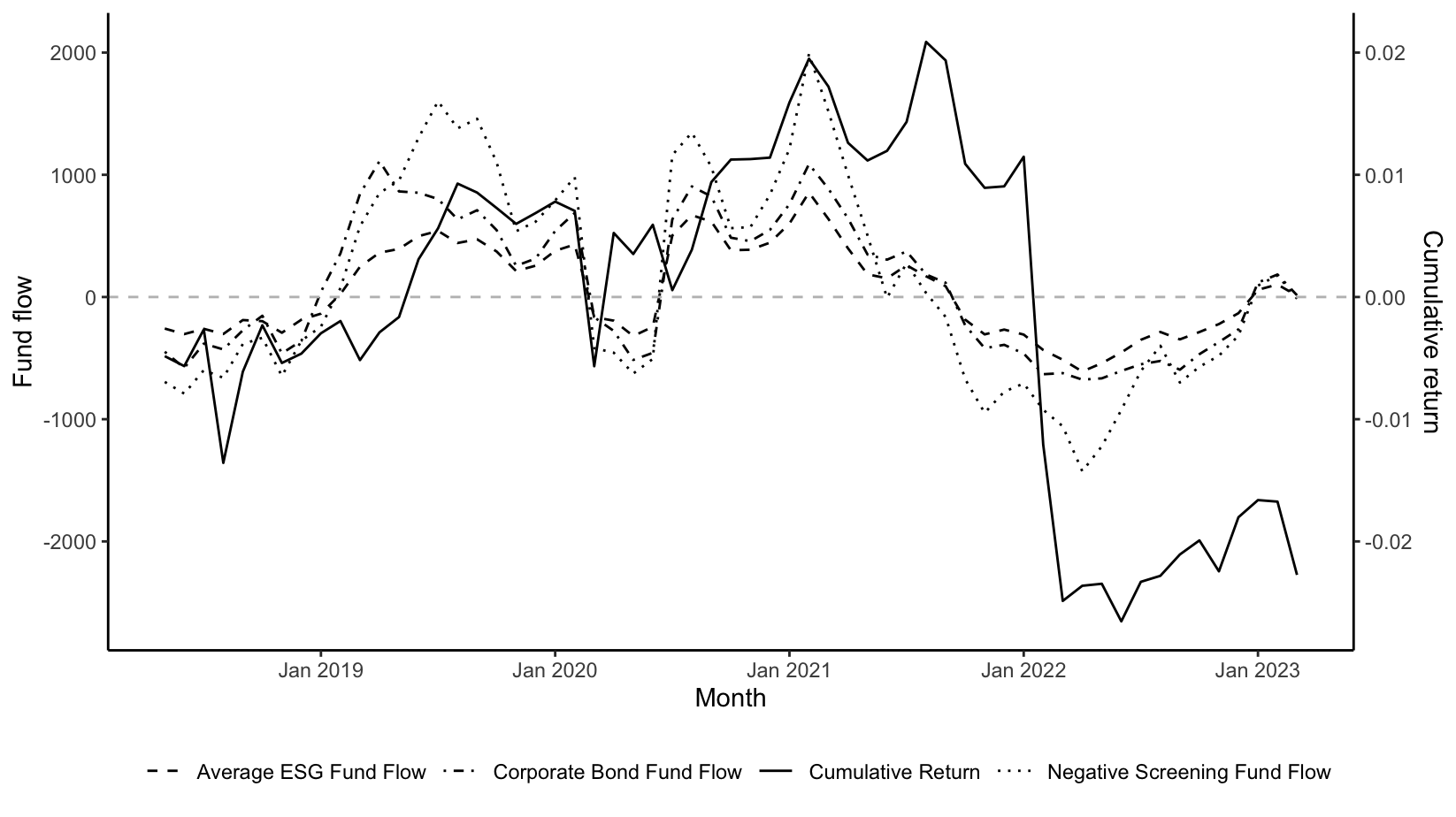

The globalization of capital flows to emerging markets brings down green firms' cost of capital more than that of brown firms. We analyze a proprietary dataset and the liberalization of China's onshore bond market to document this differential effect.

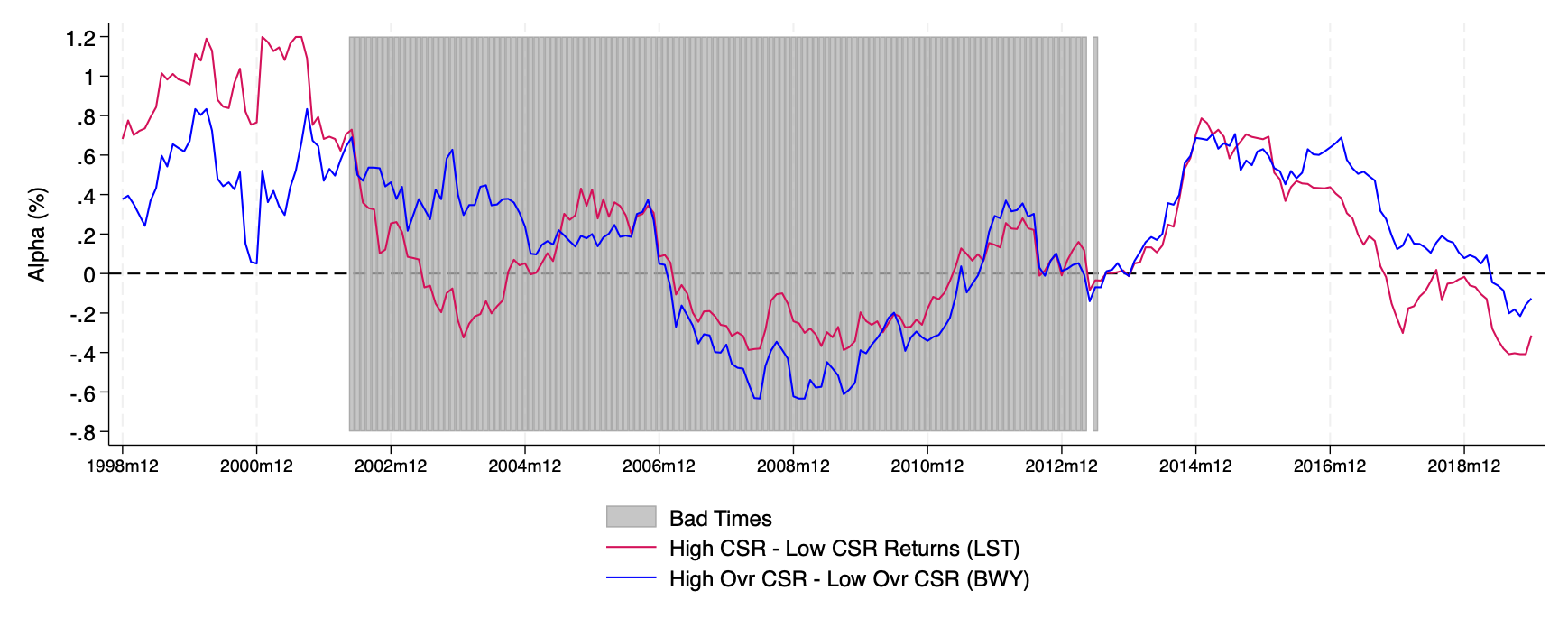

We reconcile the findings of two influential studies that arrive at seemingly contradictory conclusions regarding whether green stocks outperform during economic downturns. We further use a classical asset pricing framework to discuss the drivers of green minus brown returns.

Examining how China's IPO approval process serves industrial policy objectives.

High ESG ratings mitigate negative market reactions to earnings disappointments.